Get Approved for Up to $500K in Funding for You or Your Business

We help entrepreneurs and small business owners unlock capital and credit — with zero upfront fees, no fluff, and real results.

4 Proven Strategies That Helped Me Secure $1M+ in Funding

Securing funding isn’t a one-size-fits-all journey. Over the years, I’ve developed four proven strategies that have helped me unlock more than $1 million in funding—and have empowered many others to achieve the same. Here’s how you can put these strategies to work for you:

Strategy One

$10K in 90 Days Strategy

No credit history? No problem. This strategy is designed to help you secure $10,000 in available credit within just 90 days — even if you're starting from scratch.

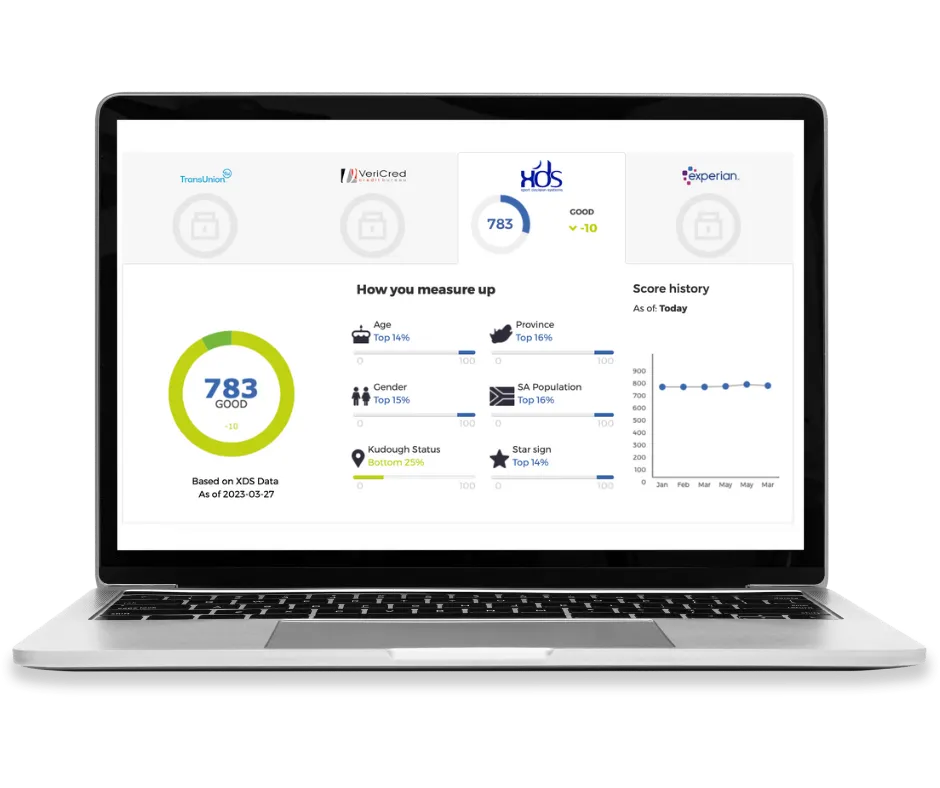

➡ Clean up your personal credit and remove negative items

➡ Add authorized user tradelines to boost your credit age

➡ Apply to the right lenders for fast approvals

➡Leverage personal credit for business funding

Ideal for: Beginners looking to build fast access to capital.

Strategy Two

$160K Funding Strategy

Ready to scale up? This strategy is for those who want to secure six figures in funding to launch or grow their business.

➡Optimize your credit profile (680+ FICO) for higher limits

➡ Set up LLCs with the right codes for low-risk industries

➡ Apply strategically with a strong, business-ready profile

Ideal for: Entrepreneurs looking to launch or scale their business with serious funding.

Strategy Three

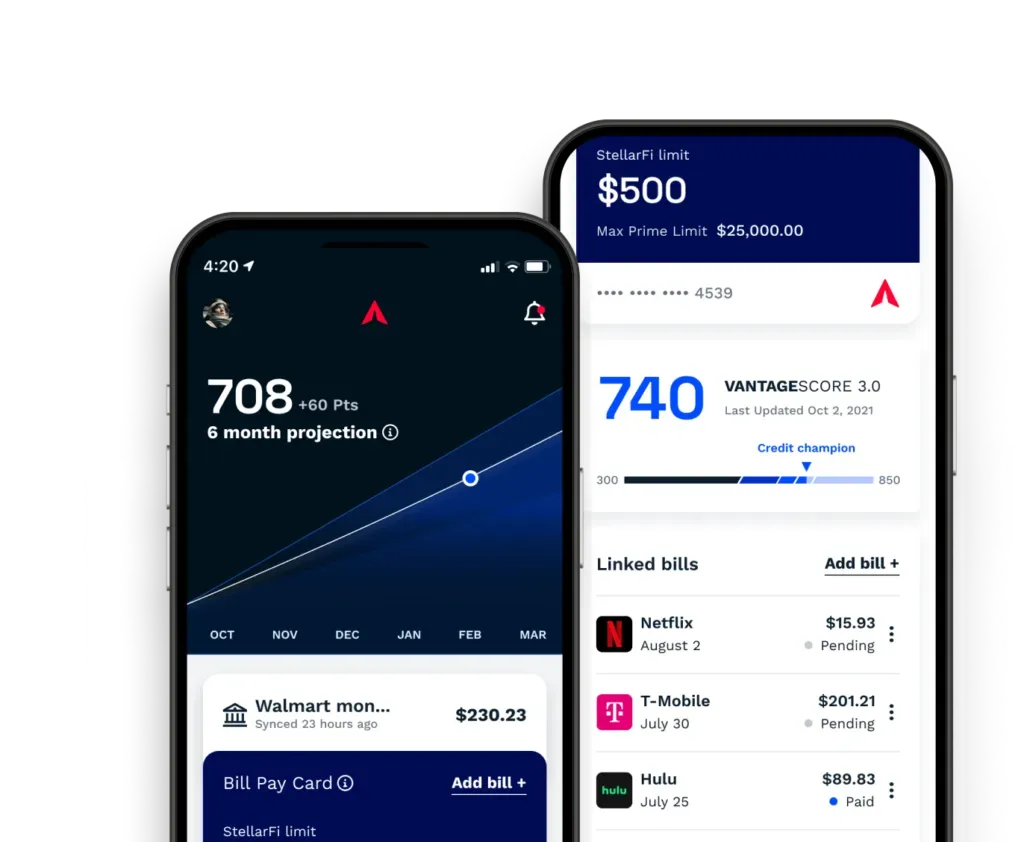

Midnight Credit Hack

Want to increase your credit limits with Navy Federal? I’ve cracked the code on how to get multiple credit limit increases quickly and easily.

➡ Clean up your personal credit and remove negative items

➡ Apply for credit limit increases every 90 days — after midnight for better approval odds

➡ Follow my step-by-step process to go from $12K to $80K (or more) in credit limits

➡ Maintain your credit usage and payment habits to keep scaling

Ideal for: Those looking to increase their credit limits quickly and efficiently.

Strategy Four

Relationship Based Lending

Sometimes, funding isn't about your credit score — it's about who you know. This strategy teaches you how to build relationships with banks and lenders to unlock funding beyond just your credit profile.

➡ Open accounts with small banks and credit unions for flexible approval

➡ Build relationships with business bankers and loan officers

➡ Apply through the right channels to access larger lines of credit

Ideal for: Anyone who wants to tap into funding options based on trust and relationships, not just credit scores.

Ready To Secure Funding And Take Your Business Or Personal Credit To The Next Level?

These are the strategies I’ve used to secure over $1M in funding for myself and helped dozens of others do the same. Let me help you do the same.

Don’t Let Lack of Capital Hold You Back

You Have the Vision. We Fund It.

❌ Can’t scale because of cash flow issues.

❌ Denied by banks due to credit score or income.

❌ Stuck waiting on loans that never come through.

❌ Missing out on deals, hires, and growth.

Whether you're launching a new business, scaling an existing one, or just trying to stay afloat — access to capital changes everything. We help business owners like you secure up to $500K in funding quickly, so you can move forward with confidence.

How We Help You Win

Funding Solutions That Work for You — Not the Banks

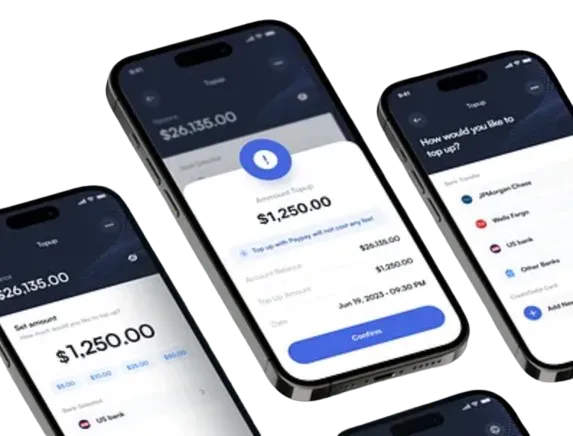

0% Intro Credit Offers

Take advantage of 0% APR credit stacking strategies for 6–18 months.

Unsecured Business Credit Lines

Access revolving credit to cover marketing, payroll, inventory, or expansion.

Term Loans & Working Capital

Get fast, flexible cash to fund your next big move.

Who We Are

Built by Entrepreneurs, For Entrepreneurs

We’re not just another funding company — we’re a team of real entrepreneurs, credit strategists, and finance experts who’ve been where you are: big goals, limited resources, and banks that say no.

That’s why we created a better way. We’ve helped hundreds of business owners unlock the capital they need to grow, launch, or bounce back — without the red tape or runaround.

Whether you’re just starting out or scaling to seven figures, our mission is simple: Give you the tools, funding, and confidence to win.

Real Results, No Fluff – I've personal done over $1,000,000 in funding.

No Upfront Fees, Ever – You don’t pay a dime until you get approved.

Tailored Strategies – You’ll get a funding plan built around your goals and timeline.

30+

Years Experience

Quick Pre-Qualification

Fill out a short form — no impact to your credit.

Get Matched With Options

We’ll review your profile and show you the best funding you can access.

Receive Funds or Credit

You’ll get expert guidance to unlock capital fast and use it strategically.

What You Can Do With $100K+ in Funding

Build Freedom.

Take Back Control.

Launch or scale your business

Hire a team or invest in training

Run ads or build out marketing

Buy inventory or upgrade equipment

Consolidate high-interest debt

Invest in real estate or a franchise

Frequently Asked Questions

How long does credit repair take?

Most clients see improvements in 30–90 days. Results vary depending on your credit profile.

Can you remove all negative items?

We target anything inaccurate, outdated, or unverifiable. If it’s valid and recent, we’ll help you rebuild from there.

Is credit repair legal?

Yes! Everything we do is 100% legal and based on your rights under the Fair Credit Reporting Act (FCRA).

Your trusted partner in financial growth and credit success, committed to securing your financial future.